Who are the Stakeholders of Decision Governance?

As decision governance influences how decisions are made, everyone who participates in preparing a decision, makes the decision, and lives with the consequences of it, is a stakeholder in the design and change of decision governance.

When you design new or change existing decision governance, it is necessary to determine whose input needs to be accounted for – their opinions, preferences, requirements, and other considerations which you will take into account. How do we identify those stakeholders that matter, or more flexibly, how do we distinguish more from less important stakeholders?

This text is part of the series on decision governance. Decision Governance is concerned with how to improve the quality of decisions by changing the context, process, data, and tools (including AI) used to make decisions. Understanding decision governance empowers decision makers and decision stakeholders to improve how they make decisions with others. Start with “What is Decision Governance?” and find all texts on decision governance here.

If important stakeholders are ignored, they will likely not provide support to changes of decision governance, or may simply oppose them. Changes will be unsuccessful.

What is a stakeholder of decision governance?

In the context of decision governance, a stakeholder refers to any individual, group, or organization that can affect and, or be affected by the preparation, making, and outcomes of a decision.

Many decisions are important because they have many stakeholders. Governance that shapes how these decisions are made inherits that importance. An easy example are rules that define how elections in a democracy need to be executed: all citizens are stakeholders. Changes to the governance of an electron process are consequently carefully governed, and infrequently done. In some countries, such changes will involve a referendum, as perhaps the means that involves the most stakeholders in some way in the change of governance.

In most cases that involve many stakeholders, it is unclear what the best practical way is to collect and aggregate specific inputs from every single one of them. Instead, when we design or redesign decision governance, we need to identify stakeholders, but then select the subset that we will invest the most effort to understand, and adjust governance accordingly.

How to manage that variety of stakeholders? In an influential paper, Mitchell, Agle, and Wood (1997) suggest that we should distinguish stakeholders using three key attributes: power, legitimacy, and urgency.

- Power: The extent to which a stakeholder can influence the decision.

- Legitimacy: The perceived appropriateness or desirability of a stakeholder’s involvement based on societal norms, values, or legal frameworks. Stakeholders with legitimate claims are more likely to be considered credible participants in decision-making.

- Urgency: The degree to which a stakeholder’s demands require immediate action. Urgency arises from

- time sensitivity, or how quickly the issue requires resolution, and

- criticality, or the importance of the issue to the stakeholder.

The rest of this text uses the above to describe stakeholders in a decision process that yields estimates of risk for a specific kind of financial instrument.

Example: Decisions about the level of risk associated with financial instruments in the subprime mortgage crisis

The subprime mortgage crisis of 2007–2008 resulted from a complex interplay of financial practices, misaligned incentives, and weak regulatory oversight. Key drivers leading to the crisis included the following.

- Lax lending standards: Widespread issuance of subprime loans to borrowers with low creditworthiness.

- Securitization and mispricing of risk: Mortgage-backed securities spread risk across markets but hid the true level of default risk.

- Speculative housing bubble: Rising home prices encouraged excessive borrowing and risky behavior.

- Rating agency failures: Credit rating agencies assigned high ratings to risky financial products.

- Regulatory weaknesses: Insufficient oversight allowed risky practices to flourish.

- Market contagion: Financial losses spread quickly due to the globalized nature of credit markets.

Consider mispriced risk only. It refers to the incorrect assessment or valuation of the probability and impact of potential losses associated with financial assets, leading to securities being sold at inappropriate prices relative to their actual risk. In the context of the subprime mortgage crisis, mispricing occurred when mortgage-backed securities (MBS) and collateralized debt obligations (CDOs) were given higher credit ratings and traded at prices that did not reflect the true level of default risk within the underlying mortgages. Why was risk assessed wrong? Typical reasons for mispriced risk are listed below.

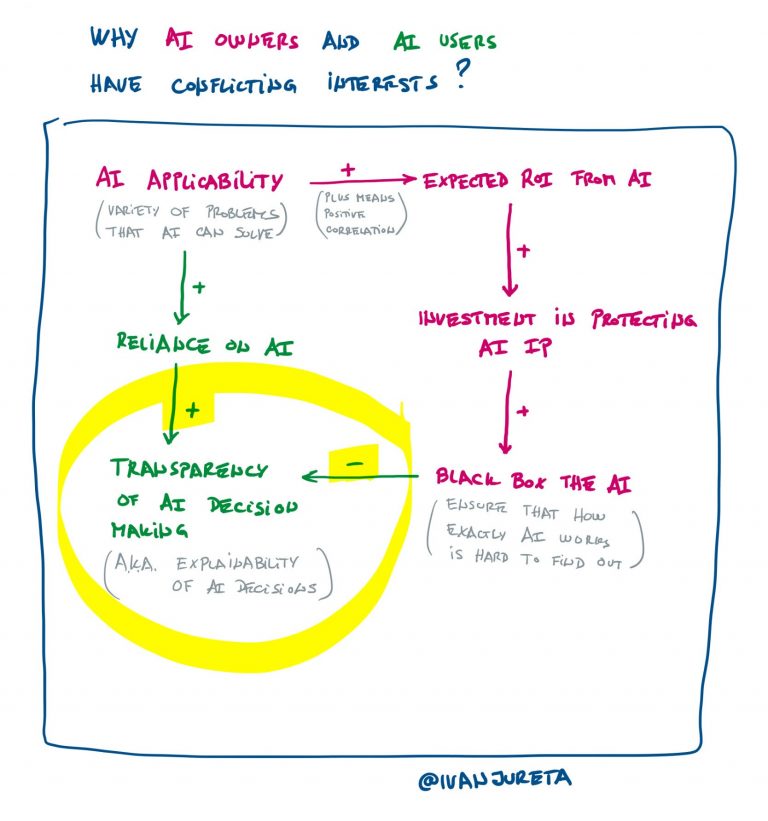

- Conflict of Interest: Rating agencies were paid by the issuers of MBS and CDOs, creating a conflict of interest. Agencies had incentives to inflate ratings to secure repeat business from banks and financial institutions.

- Blind Spot for Systemic Risk: Models assumed that geographic diversification would prevent a simultaneous increase in defaults, underestimating the risk of a nationwide housing crash. The agencies overlooked how interconnected the housing market and financial products had become.

- Inadequate Stress Testing: Agencies did not conduct sufficient stress tests to evaluate how these securities would perform under extreme market conditions (e.g., sharp declines in home prices).

- Complexity of CDOs: CDOs contained layers of other securities, including lower-rated MBS, creating opaque and complex instruments. Agencies struggled to assess these products accurately and often misclassified them with higher ratings.

- Overconfidence in AAA Ratings: A significant portion of MBS and CDO tranches were rated AAA, giving investors a false sense of security. This over-reliance on ratings led to significant investments by pension funds, insurance companies, and other institutions in what were essentially high-risk assets.

While these are relevant factors, one that is not as clear, yet underpins a lot of them, is the absence of specific stakeholders in the decision processes which yielded risk estimates. A nice touch in the movie The Big Short, based on Michael Lewis’ book, is when Porter and Danny, two analysts, go to Florida to see some of the homes financed through mortgages incorporated in financial instruments that they want to understand risk of. They find empty homes and unpaid mortgage bills.

“Porter and Danny get out of a rental car and consider a failed development. Four model houses sit alone, closed for business, their perfect yards surrounded by cyclone fencing.

Street lights now come on across the empty and half finished subdivision. Danny and Porter are puzzled, and intrigued.

Danny: It’s like they just walked away…

(Interior of a conference hall, in a hotel, that night.)

Two-hundred eager participants attend a seminar called, “You Can Be a Real Estate Millionaire!”

Seminar leader: Real estate is the only entrepreneurial activity available to all Americans. Why? Simple, it doesn’t require capital. That’s right. Let me say that again. You don’t need money to be a real estate millionaire!

In the back, Porter sips a hotel takeaway cup, stunned, appalled. Danny takes notes. An eager greeter spots them. She slips out.

Greeter: Hello gentlemen. Are you interested in the 10 CD set? Only 2999 dollars!

Porter: We’re good! Thank you.

Porter and Danny slip away.”

From the script for the film The Big Short, 2015, by Charles Randolph and Adam McKay, based upon the book by Michael Lewis.

Table 1 shows a hypothetical analysis of the stakeholders in decisions resulting in the evaluation of CDO risk. The analysis describes stakeholders using the three properties that Mitchell, Agle, and Wood (1997) recommended – power, legitimacy, urgency.

| Table 1: Using “Toward a Theory of Stakeholder Identification and Salience” to categorize stakeholders involved in the evaluation of CDO risk. | |||

| Stakeholder | Power | Legitimacy | Urgency |

| Investment Banks | Created and structured CDOs, influencing the financial market and investors. | Central to market operations as financial intermediaries. | Pressured to issue CDOs to maintain profitability and meet demand. |

| Credit Rating Agencies | Determined the perceived risk and value of CDOs, influencing investor behavior. | Viewed as authoritative assessors of credit risk. | Market pressure existed, but they did not treat systemic risks as urgent. |

| Hedge Funds and Short Sellers | Wielded financial power by betting against the housing market. | Viewed skeptically, with some seeing them as opportunistic or unethical actors. | Needed to act quickly to profit from market mispricing before the collapse. |

| Borrowers (Homeowners) | Had no influence over loan terms or financial products. | Essential participants in the mortgage market as borrowers. | Faced urgent risks of foreclosure when housing prices fell and rates rose. |

| Regulators and Government Agencies | Regulatory frameworks were weak, limiting their influence. | Responsible for market oversight and public protection. | Warnings were largely ignored until the crisis hit. |

| Institutional Investors | Held large sums of money, shaping market demand for CDOs. | Investments driven more by trends and ratings than by active risk assessment. | No immediate threat was perceived at the time of investment. |

| Consumer Advocacy Groups | Lacked influence over financial institutions or policies. | Raised early concerns about predatory lending practices. | Their warnings were not treated as relevant or pressing. |

| Mortgage Brokers and Loan Originators | Limited power in the broader financial system but influenced loan volumes. | Many engaged in predatory practices, undermining their credibility. | Faced immediate pressure to close loans and meet sales targets. |

It is easy to say, after the fact, that the decision processes which yielded risk estimates were flawed, and then point to various issues they must have had given the resulting mayhem. So it is not very insightful to say only that stakeholders were missed, and if they are included in the future, risk assessments will be less wrong – in general, simply considering someone as a stakeholder is not enough, they need to have incentives to want to be part of decision making, and they need to be outfitted with appropriate decision rights and responsibilities.

In other words, power, legitimacy, and urgency are not enough. We need to add the interests of the stakeholders, which will then determine how we choose to adapt decision governance according to their interests, power, legitimacy, and urgency.

References and Further Reading

- Mitchell, R. K., Agle, B. R., & Wood, D. J. (1997). Toward a theory of stakeholder identification and salience: Defining the principle of who and what really counts. Academy of Management Review, 22(4), 853–886.

- Donaldson, T., & Preston, L. E. (1995). “The Stakeholder Theory of the Corporation: Concepts, Evidence, and Implications.” Academy of Management Review, 20(1), 65-91.

- Freeman, R. E., Wicks, A. C., & Parmar, B. (2004). “Stakeholder Theory and ‘The Corporate Objective Revisited.’” Organization Science, 15(3), 364-369.

- Jensen, M. C. (2002). “Value Maximization, Stakeholder Theory, and the Corporate Objective Function.” Business Ethics Quarterly, 12(2), 235-256.

Decision Governance

This text is part of the series on the design of decision governance. Other texts on the same topic are linked below. This list expands as I add more texts on decision governance.

- Introduction to Decision Governance

- Stakeholders of Decision Governance

- Foundations of Decision Governance

- How to Spot Decisions in the Wild?

- When Is It Useful to Reify Decisions?

- Decision Governance Is Interdisciplinary

- Individual Decision-Making: Common Models in Economics

- Group Decision-Making: Common Models in Economics

- Individual Decision-Making: Common Models in Psychology

- Group Decision-Making: Common Models in Organizational Theory

- Role of Explanations in the Design of Decision Governance

- Design of Decision Governance

- Design Parameters of Decision Governance

- Factors influencing how an individual selects and processes information in a decision situation, including which information the individual seeks and selects to use:

- Psychological factors, which are determined by the individual, including their reaction to other factors:

- Attention:

- Memory:

- Mood:

- Emotions:

- Commitment:

- Temporal Distance:

- Social Distance:

- Expectations

- Uncertainty

- Attitude:

- Values:

- Goals:

- Preferences:

- Competence

- Social factors, which are determined by relationships with others:

- Impressions of Others:

- Reputation:

- Promises:

- Social Hierarchies:

- Social Hierarchies: Why They Matter for Decision Governance

- Social Hierarchies: Benefits and Limitations in Decision Processes

- Social Hierarchies: How They Form and Change

- Power: Influence on Decision Making and Its Risks

- Power: Relationship to Psychological Factors in Decision Making

- Power: Sources of Legitimacy and Implications for Decision Authority

- Power: Stability and Destabilization of Legitimacy

- Power: What If High Decision Authority Is Combined With Low Power

- Power: How Can Low Power Decision Makers Be Credible?

- Social Learning:

- Psychological factors, which are determined by the individual, including their reaction to other factors:

- Factors influencing information the individual can gain access to in a decision situation, and the perception of possible actions the individual can take, and how they can perform these actions:

- Governance factors, which are rules applicable in the given decision situation:

- Incentives:

- Incentives: Components of Incentive Mechanisms

- Incentives: Example of a Common Incentive Mechanism

- Incentives: Building Out An Incentive Mechanism From Scratch

- Incentives: Negative Consequences of Incentive Mechanisms

- Crowding-Out Effect: The Wrong Incentives Erode the Right Motives

- Crowding-In Effect: The Right Incentives Amplify the Right Motives

- Rules

- Rules-in-use

- Rules-in-form

- Institutions

- Incentives:

- Technological factors, or tools which influence how information is represented and accessed, among others, and how communication can be done

- Environmental factors, or the physical environment, humans and other organisms that the individual must and can interact with

- Governance factors, which are rules applicable in the given decision situation:

- Factors influencing how an individual selects and processes information in a decision situation, including which information the individual seeks and selects to use:

- Change of Decision Governance

- Public Policy and Decision Governance:

- Compliance to Policies:

- Transformation of Decision Governance

- Mechanisms for the Change of Decision Governance